An Individual Retirement Account (IRA) is a type of savings account that is designed to help you save for retirement and offers many tax advantages. Traditionally, financial institution offers you an IRA that is essentially a portfolio which consists of stocks, bonds and other underlying assets. While most of these portfolios are believed to be low risk-low reward entities, the glass was shattered with the onset of financial crisis. With the collapse of the financial markets in 2008, people have been on the lookout for a safer investment option for their IRA.

Among the types of IRA available, Self–Directed IRAs have been gaining recognition in the recent times. While most traditional IRAs limit themselves to stocks and bonds, Self–Directed IRAs allow you to invest in real estate, notes, private placements and metals. This type tends to provide you more control of your retirement savings beyond choosing the type of off-the-shelf mutual fund. Since you get to select from a wide array of options, there is a possibility of increasing your profits multifold. Among the options available, let us see why real estate is proving to be a solid investment:

Sought out alternative:

The idea of real estate as a major component in an IRA took off with the big crash in 2008. The younger generation was exposed to the volatility of the financial markets. They quickly understood that they need a study investment with good returns over a period of time. Hence real estate became the cynosure of discussion as it readily fits into the desired criteria.

High Return potential:

The value of any quantity with a limited supply characteristic would only go onto increase with time. Since land and related properties are limited, investing in real estate has a very high return potential over a period of time. The value increases further with the kind of locality, area and developments that would take place in its vicinity. It is for the same reason, investing in real estate has become a lucrative option for investors eyeing retirement.

Portfolio Diversification and Inflation Hedge:

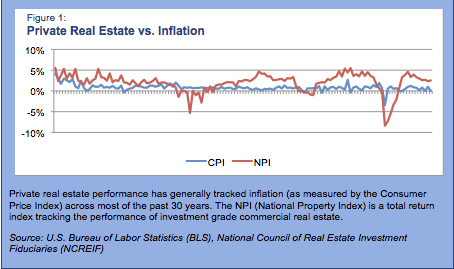

In addition to providing a hedge against inflation, private real estate can also generate relatively high levels of current income.

When designing IRAs that can provide high returns, there is a great amount of risk involved, especially with volatile components. Hence real estate can serve as a strong portfolio diversifier, with high reward probability at low risk levels. Owing to its non-correlation with other financial entities, it can very well act as a hedge against inflation.

Sense of security:

Stocks and financial instruments are intangible. With changes in world markets and sudden turmoil, equities can suddenly be rendered useless. But in the case of real estate, people actually own the property. This sense of ownership brings in a sense of security.

Real estate has proven itself to be a strong market for investments and it can be safely said that opening Real Estate IRA is a lucrative and profitable option to plan your retirement.